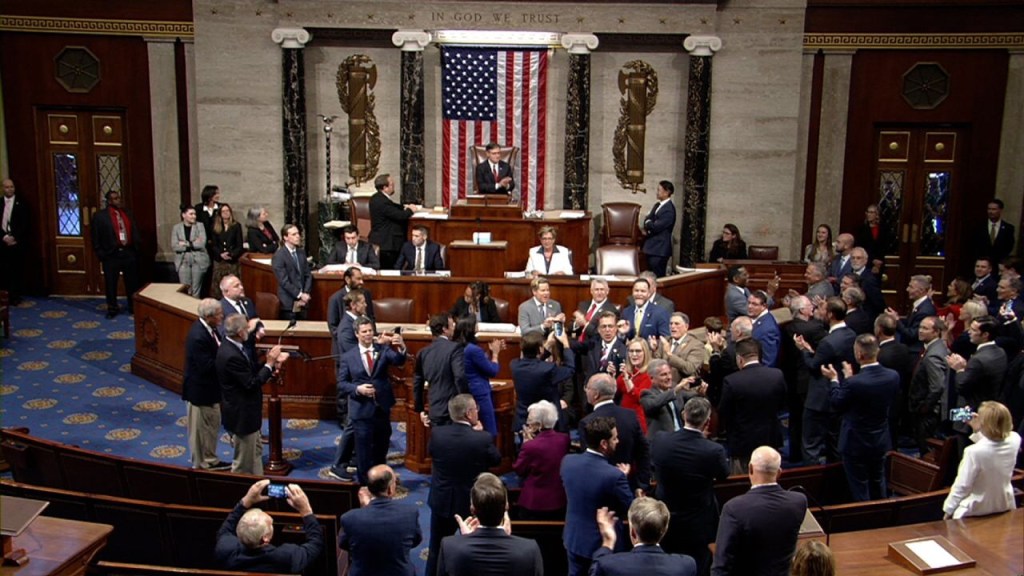

In a significant political development, President Donald Trump’s much-anticipated “Big Beautiful Bill” has successfully passed through Congress and is poised to become law once it receives the President’s signature. This legislation, which is characterised by its sweeping reforms in various sectors including healthcare, taxation, and infrastructure, has generated both enthusiasm and skepticism across the political spectrum. As we delve into the implications of this legislation, it is crucial to assess its potential impact on marginalised communities in the United States, as well as the benefits it may confer upon the wealthy.

The Big Beautiful Bill: An Overview

Before analysing its effects, it is essential to outline the key components of the Big Beautiful Bill. Broadly, the legislation aims to stimulate economic growth through tax cuts and deregulation, enhance infrastructure development, and reform healthcare. Proponents argue that these measures will result in job creation and increased economic activity, while critics warn that the bill disproportionately favours affluent individuals and corporations.

Effects on Marginalised Communities

- Healthcare Accessibility: One of the most contentious aspects of the bill is its proposed changes to healthcare. Critics argue that the legislation could lead to reduced funding for programmes that serve low-income and marginalised communities. With potential cuts to Medicaid and other public health initiatives, many individuals could face increased barriers to accessing necessary medical services. This is particularly concerning given that marginalised populations often rely heavily on these programmes for their healthcare needs.

- Economic Disparities: While the bill promises job creation, the nature of the jobs generated is a critical factor. If the focus is on high-skill, high-wage positions, many marginalised individuals may find themselves excluded from the economic recovery. Furthermore, if the jobs created are predominantly in sectors that do not provide adequate wages or benefits, the economic uplift may not be felt by those who most need it.

- Education and Training Programmes: The potential reduction in federal support for education and vocational training programs could further entrench systemic inequalities. Marginalised communities often rely on these programs to gain skills and secure employment. If funding is diverted to support tax cuts for the wealthy, the long-term socioeconomic mobility of these groups could be severely hindered.

- Social Services Funding: The Big Beautiful Bill’s focus on tax reductions may lead to cuts in social services that provide essential support to marginalised individuals. Programs that address food insecurity, housing instability, and mental health services could face substantial challenges as funding becomes increasingly limited. The potential erosion of these services could exacerbate existing disparities and lead to a decline in quality of life for vulnerable populations.

Benefits for the Wealthy

- Tax Cuts and Incentives: The most immediate benefit of the Big Beautiful Bill for the wealthy is the proposed tax cuts. By lowering income tax rates and providing significant deductions for high earners and corporations, the legislation is designed to enhance the disposable income of affluent individuals. This could lead to increased investment in private enterprises , but it also raises questions about the equitable distribution of wealth.

- Deregulation: The bill’s emphasis on reducing regulatory barriers is likely to benefit wealthy business owners and corporations, enabling them to operate with greater flexibility and lower costs. While proponents argue that this will foster growth and innovation, critics contend that it could come at the expense of environmental protections and workers’ rights, potentially leading to long-term societal costs.

- Infrastructure Development: While infrastructure is crucial for economic growth, the allocation of funds may disproportionately favour areas where wealthy constituents reside. This could result in a widening gap in infrastructure quality between affluent and low-income neighbourhoods, further entrenching economic divides.

- Long-term Wealth Accumulation: The cumulative effects of tax cuts and deregulation could lead to significant wealth accumulation for the upper echelons of society, allowing them to leverage their financial resources for further investment opportunities. This could perpetuate a cycle of wealth accumulation that marginalises lower-income individuals and communities over time.

Finally

As the Big Beautiful Bill awaits the final signature to become law, its implications for marginalised communities and the wealthy are becoming increasingly clear. While proponents tout the potential for economic growth and job creation, the risks of exacerbating existing inequalities cannot be overlooked. The legislation stands to benefit affluent individuals significantly, while potentially undermining the support systems that are vital for marginalised populations.

In the wake of this legislative development, it is essential for policymakers, advocates, and community leaders to remain vigilant and engaged. Ensuring that the voices of marginalised communities are heard in the ongoing discourse surrounding the Big Beautiful Bill will be critical to fostering an equitable society that prioritises the well-being of all citizens, not just the affluent few. The true measure of this legislation’s success will be its ability to uplift those who have long been marginalised, creating a more inclusive and prosperous future for the United States.